cash app international atm

Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will. Two Cash App Scams You Need To Avoid Today.

Can You Use Cash App Card At Atm What Atm Is Free For Cash App

Cash App is a peer-to-peer money transfer service developed by Block Inc.

. For your protection your Cash Card ATM withdrawals are limited. Dollar amount for all ATM withdrawals processed in foreign currency. The mobile app is available for iOS and Android and is widely popular.

Mar 18 1702 PDT. If you verify your account your Cash App limit will increase¹. Cash App can serve as a one-stop shop for many of your financial needs.

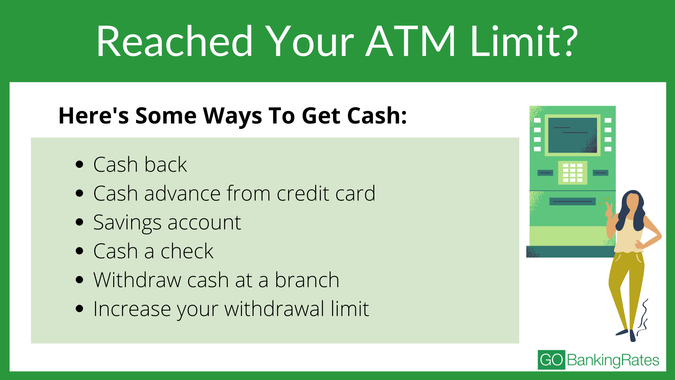

Cash App instantly reimburses ATM fees including ATM operator fees for customers who get 300 or more in paychecks directly deposited into their Cash App each month. That allows users to send and receive money. Theres a cap on reimbursement A maximum of 7 will be reimbursed per withdrawal meaning a cap of 21 per 31-day period will be reimbursed.

Cash App supports international payments between the US and the UK. Identified - The issue involving Cash Cards and direct deposit accounts for some teen accounts has been identified and our team is working on a fix. According to the Cash App Help page the service does not currently support payments to international recipients This means if you are living in the US.

Sending Money Charges 3 fee of total amount with a linked card. Lets take a look at Cash Apps fees. You can now send or request Cash App payments with friends located in the UK.

Although theres no Cash App daily limit with an unverified account youre limited to receiving 1000month. Cash App instantly reimburses ATM fees including ATM operator fees for customers who get 300 or more in paychecks directly deposited into their Cash App each month. Cash App International Atm.

Cash App ATM Withdrawal Limit Cash App Support ATM Withdrawal Limit. In June alone more than 30 million people used the Cash App for transactions and its ranked No. View transaction history manage your account and send payments.

With a Cash App account you can receive paychecks up to 2 days early. Click add cash select an amount to add. You can use your Cash Card to get cashback at checkout and withdraw cash from ATMs up to the following limits.

Cash App supports international payments between the US and the UK. You can avoid fees Up to 3 ATM withdrawals per 31 days will be reimbursed if you receive paycheck direct deposits to your Cash App account that total more than 300 per month. You can make transactions or online payments purchases only in the.

Dollar equivalent of your foreign ATM withdrawal. Your deposit account statement will reflect the US. Mar 18 1825 PDT.

Hopefully this option will be added in the future. In addition to getting free money from daily activities the app offers several exciting banking investing and debit card perks. Bank of America will assess an international transaction fee of 3 of the US.

Owned and run by Square Inc it is a mobile-first peer-to-peer P2P payment service bank account debit card and investing service all in one. Cash App ATM fee. The cash app debit card works at any atm.

Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will add an additional 31 days of ATM fee reimbursements. While Fidelity reimburses all ATM fees charged by foreign banks worldwide they still charge a 1 foreign transaction fee. Once youve activated this free ATM withdrawal service Cash App will reimburse you for up to 3 ATM withdrawals per 31.

Cash App charges an ATM fee of 2 for withdrawals⁴ But one neat thing with Cash App is that if you receive 300 or more per month in directly deposited paychecks then Cash App will instantly reimburse you for ATM fees. It does not provide services with international merchants. And since its owned by Square you can be assured its a safe app to use for money transactions.

ATM Fees Cash Card use at any ATM is 2 fee per use. You can get free ATM withdrawals if you deposit at least 300 per month into your Cash App account. In addition the ATM operator may charge an access fee for cash withdrawals.

Cash App mobile wallet is growing in popularity because there are several legit ways to get free money on the Cash App. When you send a payment outside the US Cash App will convert the. This service can help you send your share of.

Monitoring - A fix has been implemented and we are monitoring the results. You cant add money to a cash app at an ATM because cash app businesses dont offer this feature. Plus ATM withdrawals are free when you have at least 300 coming in each month.

Get a personalized debit card use your debit card where visa is accepted even online. With no monthly fee Cash App may be a good fit for those who want to send money conveniently and perhaps dip. Cash apps do not have the capability of adding money from an ATM.

If youre traveling a lot those costs could add up over time. Cash App is just one of many products that Square offers to help. Once the fix is in place any affected accounts should function as normal.

1000 per 24-hour period. Keep in mind that you cannot use a Cash App card outside the US. Cash App SupportInternational Payments.

Instant Transfers Charges 15 of transfer amount. You just need your Cash App debit card and Cash PIN at the time of the withdrawal. How much you can send and receive differs depending on whether your Cash App account is verified or not.

International ATM operators may offer to do your. Speed up your direct deposits. Cash App sending limit - how to increase it.

So while a 4 ATM fee on a 100 ATM withdrawal is 4 a 1 foreign transaction fee on a 400 ATM withdrawal gets you to the same number. 1 in the app store finance category. Cash App is a peer-to-peer payment app created by Square Inc.

If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. Cash app is a popular platform that now has surpassed 25 million monthly active users. You can use any ATM nationwide to withdraw cash from your Cash App account.

Cash App does not work internationally. 1 in the App Store finance category. So sending someone 100 will actually cost you 103.

Cash app is a financial services company not a bank. Cash Cards work at any ATM with just a 2 fee charged by Cash App. Updated on Friday October 16 2020.

Sign in to your Cash App account. Many ATM cash deposit options have made it quite simple to avoid visiting a bank that accepts money deposits.

When Does Cash App Weekly Limit Reset Cash App Sending And Withdrawal Limit

Cash App International Transfers Uncovered Transumo

Does Cash App Work Internationally Wise Formerly Transferwise

Is Cash App Available In Europe Alternatives For 2022

6 Best Check Cashing Apps Get Money Fast Gobankingrates

Cash App Limit 2022 Daily Weekly Monthly Transaction Limits

Does Cash App Work Internationally Wise Formerly Transferwise

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

16 Best Freelance Payment Methods In 2019

Does Cash App Work Internationally Wise Formerly Transferwise

Can You Use Cash App Card At Atm What Atm Is Free For Cash App

Paypal Paypal Cash Card Direct Deposit And Cash Load

Cash App International Transfers Uncovered Transumo

International Payments Exchange Rates

Does Cash App Work Internationally Wise Formerly Transferwise

Find No Fee Free Atms Near You Avoid Fees Gobankingrates

Cash App Vs Venmo Exposed 8 Must Knows